Within the past week, I have had the opportunity to listen to our Mayor Bronin speak about Hartford. He participated on a panel of four Connecticut mayors speaking at the State Historic Preservation Office conference in Storrs. Each was asked about the successes of community economic development brought about by historic preservation projects in their cities. These mayors of Vernon, New London, Danbury and Hartford called the “lovables”, by moderator Helen Higgins former executive director of the CT Trust for Historic Preservation, highlighted signature projects which sparked the rejuvenation of their cities and making the downtowns livable once again. Impressive projects have been completed and the economic effect on these cities is remarkable.

Mayor Bronin listed the revitalization projects in downtown Hartford involving millions of dollars of private and public investment now to bring residents where once stood vacant and abandoned buildings for many years. Roughly 1,500 new residential units have been created by the adaptive reuse of historic buildings; some quite old and others built in the 20th Century yet all now enjoying near full occupancy. Hartford seems to have come alive as a capital city located at the physical crossroad of the state but on the verge of being the hub of economic vitality it has been for centuries. This spring we welcomed a professional ball team, the Yard Goats, in a new stadium. A hot jazz club is now located in The Flying Monkey restaurant located at Brainard Field our regional airport. As a resident I must sit back and admire that in the main Hartford appears to be on the rise. Sadly the daily news of one problem or another misses an appreciation of the steady beat of progress. Unfortunately one thing we in Hartford do all too well.

Last evening I sat in on Mayor Bronin’s town hall meeting to learn about the budget being proposed. It is not a happy thing to live with for we residents. All things being equal the city faces a budget shortfall of roughly $40 million. As the capital city, greater than 50 % of the real estate is tax exempt. It is a small city and the financial imbalance of the tax-free real estate is a burden which is not sustainable. Of course, we look to the State for financial relief and receive it however this year it simply is insufficient. Looking to the State we realize that it too grapples with a deficit which compounds the problem of seeking aid. So, but for all the amazing investment in Hartford, the reality is going to be a hard challenge.

Mayor Bronin has done a terrific job of promoting a concept of “regionalism”, whereby the surrounding towns share in the financial burden of Hartford. For example, the waste treatment plant which is tax exempt serves nearly all the surrounding communities. It seems logical that a shared approach benefits all towns and municipalities. Connecticut was founded on the inefficient concept of self-rule meaning that 169 towns possess their own government. We therefore employ 169 dog catchers and so on. Cities around the country benefit from a regional or consolidated government. I am most familiar with Indianapolis which has had a unified government since the 1960’s. That city of 700,000 is comprised of a region of 1,300,000. There are no “us versus them.” Rather Indianapolis comprises an operating mentality of “we”. This is a dream and a very hard sell for Hartford. Mayor Bronin has taken on the additional job of doing the hard work to improve the current financial situation and establish a sustainable future for the Capital City. We can help. As was noted last evening we, the residents of Hartford, need to celebrate all the things that can make Hartford a first-class city. Think Jazz Fest, Puerto Rican Festival, Winterfest, First Night, the River, Coltsville, etc. On any given night, the opportunities to amuse are endless. But for the cynics, Hartford is just a fine place to live, work and play. Let’s prove them wrong!

If you have paid attention to the

If you have paid attention to the  Hartford, as most major cities in New England, spiraled into a deep real estate decline in the later 80’s. Developers in anticipation of building commercial projects had purchased many historic buildings in downtown, torn them down and left major swaths of empty lots. Our Main Street is testament to the destructive acts which tore apart the fabric of the City. Still today much of this remains leaving surface parking lots where once stood 19th and 20th Century buildings of true architectural merit. The ghosts of buildings never-to-be-built haunts downtown development and stymies the recreation of a tax base on which to operate Hartford.

Hartford, as most major cities in New England, spiraled into a deep real estate decline in the later 80’s. Developers in anticipation of building commercial projects had purchased many historic buildings in downtown, torn them down and left major swaths of empty lots. Our Main Street is testament to the destructive acts which tore apart the fabric of the City. Still today much of this remains leaving surface parking lots where once stood 19th and 20th Century buildings of true architectural merit. The ghosts of buildings never-to-be-built haunts downtown development and stymies the recreation of a tax base on which to operate Hartford. allocations. These credits have provided a powerful financial tool to reuse and preserve buildings deemed to be historic. Hartford has many such buildings with an interesting twist defining historic as those 50 years of age or older. Many of the larger abandoned buildings are surprisingly defined as being historic; many have started their productive life as commercial office space. Developers have realized that the buildings may be reused as residential properties. The most striking high-profile development has been the reuse of

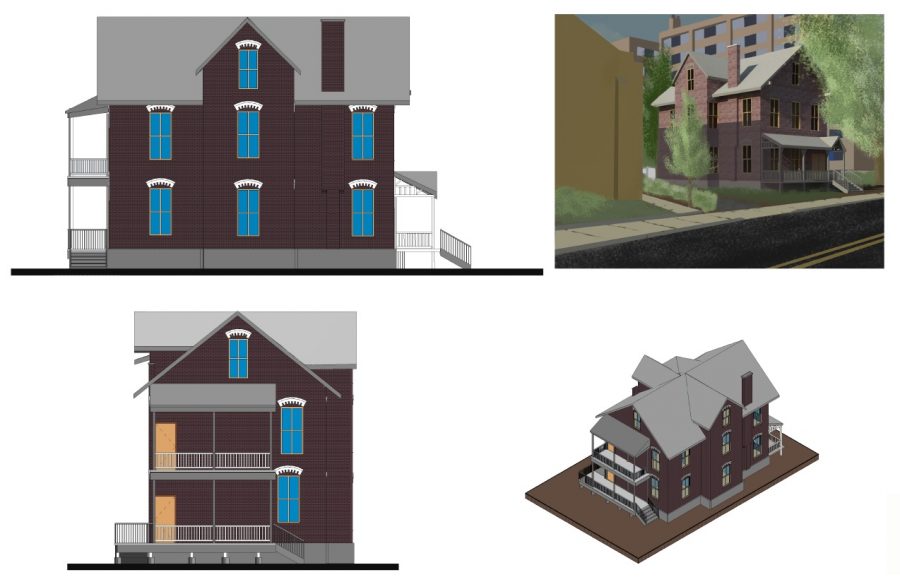

allocations. These credits have provided a powerful financial tool to reuse and preserve buildings deemed to be historic. Hartford has many such buildings with an interesting twist defining historic as those 50 years of age or older. Many of the larger abandoned buildings are surprisingly defined as being historic; many have started their productive life as commercial office space. Developers have realized that the buildings may be reused as residential properties. The most striking high-profile development has been the reuse of  We were recently notified of a potential demolition of an historic house located on Capitol Avenue. In following up we discovered that the owner of the property had purchased it as a preventive strategy to protect its substantial interests next door. We sought a meeting to discuss opportunities and found that the owner was completely frustrated with trying to sell the property, for 5 years! Seems that no one wanted to undertake a rehabilitation which would be expensive and ultimately cost more than the property would be worth. Now long-abandoned and home to squatters the owner has grown concerned and wants to be rid of the costly headache. One can be sympathetic, we know from great experience that often the cost to rejuvenate a property may exceed its investment. However, we offered to explore how to become the white knight. With experience in real estate development, finance, historic renovation technical assistance and a familiarity of market trends we determined to see what we could do.

We were recently notified of a potential demolition of an historic house located on Capitol Avenue. In following up we discovered that the owner of the property had purchased it as a preventive strategy to protect its substantial interests next door. We sought a meeting to discuss opportunities and found that the owner was completely frustrated with trying to sell the property, for 5 years! Seems that no one wanted to undertake a rehabilitation which would be expensive and ultimately cost more than the property would be worth. Now long-abandoned and home to squatters the owner has grown concerned and wants to be rid of the costly headache. One can be sympathetic, we know from great experience that often the cost to rejuvenate a property may exceed its investment. However, we offered to explore how to become the white knight. With experience in real estate development, finance, historic renovation technical assistance and a familiarity of market trends we determined to see what we could do.