HISTORIC PRESERVATION FUNDING RESTORED

. . . for now

(last updated June 14, 2017)

Governor Malloy’s deficit reduction plan to balance the current year’s budget did not include a sweep of “uncommitted” Community Investment Act (CIA) funds.

The state leadership is now in discussions over the biennial budget (Fiscal Year 2017-2018 & Fiscal Year 2018-2019). The Senate Republican proposal calls for a transfer of all CIA funding into the General Funds account – which has the potential of stopping the majority of the historic preservation work in the state.

Transferring CIA funds to the General Fund constitutes a tax increase by taking a recording fee for real estate transfers that gets reinvested back into the community and changing it to a general revenue tax.

Please take a moment out of your busy schedule and let the leadership and your individual legislators know that you are opposed to any reductions in CIA funding. We also urge you to contact your local Senator and House Representative to let them know that their vote on a budget that diverts CIA funding away from its intended uses – historic preservation, affordable housing, agriculture and open space – is unacceptable.

Budget Leadership

Governor Malloy: governor.malloy@ct.gov

Secretary, Office of Policy & Management: ben.barnes@ct.gov

Speaker of the House: joe.aresimowicz@cga.ct.gov

House Majority Leader: matthew.ritter@cga.ct.gov

House Republican Leader: themis.klarides@housegop.ct.gov

Find Your Legislators

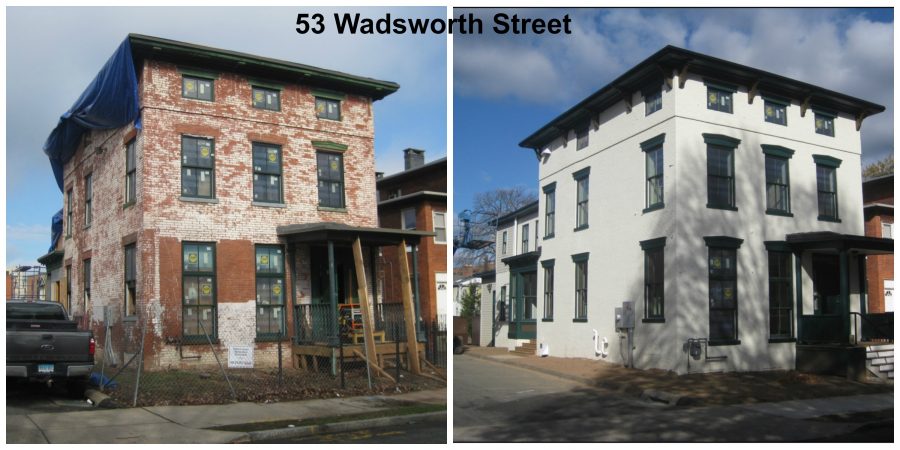

List of CIA funds invested in Hartford

List of CIA funds invested in Connecticut

Update Raising the Cap for Historic Tax Credits